| Getting your Trinity Audio player ready... |

Just like how you receive a birth certificate when you’re born and later get an Aadhar card for official records, you need different documents for various purposes as you grow. Similarly, you require registration certificates, licenses, and permits to operate legally when starting a business. These are granted by certain organizations or governments to authorize businesses.

In India, a business license is essential for individuals starting a business. The state government issued a crucial document that allows businesses to conduct specified activities within a designated area. These licenses and permits also ensure businesses comply with legal standards and regulations.

In this blog, we will explore various business registrations, licenses, and permits for running a business legally.

Let’s dive in!

Importance of understanding the legal requirements for starting a business

Understanding the legal requirements for launching a business is critical. It enables you to follow the rules, preserve assets, maintain a good reputation, avoid legal issues, access resources, and assure long-term success. Compliance with these duties prevents fines and penalties, fosters trust with customers and investors, lowers risks, and offers opportunities for your company.

To start a business in India, you’ll need the following documents for applying for various licenses:

- PAN Card.

- Driving License/Voter ID.

- Aadhar Card.

- Memorandum Of Association and Article of Association.

- Address proof – Electricity Bill, Bank Passbook, Water Bill, or Telephone Bill.

- Passport if needed.

- Partnership Agreement.

- Rent Agreement or Lease Agreement for office or factory.

- CA Certificate.

So, these are the paperwork you’ll need to start a business in India.

Also Read: 15 Best Websites For Entrepreneurs In 2024

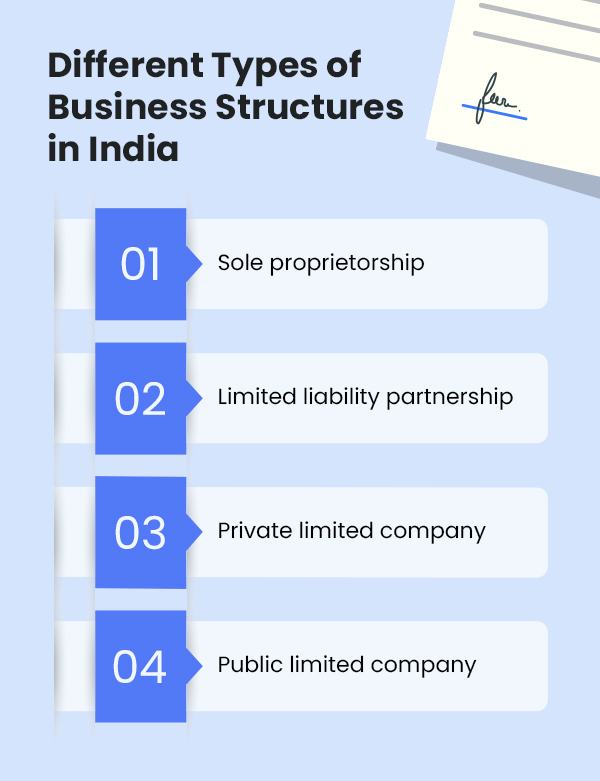

Different Types of Business Structures in India

Registering a company is the first step for starting a new business in India. There are various types of entities and company structures, so you’ve to choose the option accordingly.

Here are the various types of company registration categories available in India:

➢ Sole proprietorship

From 2013, one-person company registration enables solo proprietors to conduct their firms lawfully. It is the simplest form of business in which a single person conducts a company without an official structure. If the business operates under a different name, a DBA certificate must be filed with the county clerk’s office where it is located.

➢ Limited liability partnership

Many businesses in India start as sole proprietorships or general partnerships without requiring central government authorization. The Ministry of Corporate Affairs oversees the establishment of Limited Liability Partnerships (LLPs). So, entrepreneurs who want to establish businesses with annual earnings exceeding Rs. 20 lakhs should consider registering as LLPs or firms.

Once registered, these entities gain legal recognition, protection of promoters’ liabilities, and rights to transfer ownership.

➢ Private limited company

Usually, a business registered under a private limited company is treated as a separate legal entity from its founders and controlled by shareholders and directors.

However, registering as a PLC enables businesses and startups to raise capital and offer employees Employee Stock Ownership Plans (ESOPs), which is impossible in an LLP or sole proprietorship. Some popular companies are registered as private limited, such as Zomato, Ola, Snapdeal, etc.

➢ Public limited company

A public limited company is a legal entity founded by a voluntary association of members with limited liability for shareholders.

With a high turnover, big giants like TCS, Google, and Apple are registered as public companies, with or without plans to make an Initial Public Offering (IPO), which can help them get investment through the public by offering their shares through the stock market. The Ministry of Corporate Affairs controls and registers businesses that fall into public companies.

We suggest you seek a specialist’s assistance to understand each company structure’s ramifications to help you find which structure suits your business.

Also Read: Types Of Business Models Startups Should Know

Register Your Company

Starting a business in India has never been easier. The business registration process has moved online, making it more user-friendly and efficient. The Indian government has launched Simplified Proforma for Incorporating a Company Electronically (SPICe), a single-point application that streamlines company registration procedures.

This platform allows stakeholders to perform procedures such as company name registration, DIN (Director Identification Number) allocation, applying for a Permanent Account Number (PAN), and obtaining a Tax Collection and Deduction Account Number (TAN) with a few clicks.

You can register your business under any company structure, from a solo proprietorship to a public limited company, according to the nature and size of your business.

Various Licenses Required to Run Business in India

Here are some of the important licenses you will require to run a business in India:

➢ MSME Udyam Registration

MSME Udyam Registration, or Udyog Aadhaar, is a government-mandated registration process for India’s Micro, Small, and Medium Enterprises. It gives MSMEs official recognition and allows them to take advantage of government advantages and schemes to help them grow and thrive.

MSMEs can use this registration to get financial aid, subsidies, and other government support mechanisms to promote entrepreneurship and small-scale enterprises.

❖ Benefits of Udyam Registration

★ Access to government schemes, subsidies, and incentives for MSMEs.

★ Preferential treatment in government procurement tenders.

★ Eligibility for various subsidies and financial assistance schemes.

★ Easier access to credit facilities and loans at lower interest rates.

★ Protection under the MSMED Act against delayed payments from buyers

➢ Startup India Registration

Startup India registration is an initiative launched by the government to foster entrepreneurship and promote the growth of startups in the country. It provides various benefits, incentives, and support mechanisms to eligible startups.

Here’s an overview of Startup India registration and its significance:

❖ Who is Eligible for Startup India Registration?

- Businesses are recognized as startups per the definition provided by the Department for Promotion of Industry and Internal Trade (DPIIT), Government of India.

- Startups must meet certain criteria related to the age of the business, annual turnover, and innovation potential.

❖ Benefits of Startup India Registration

- Tax benefits: Startups are eligible for income tax exemption for a specified period under certain conditions.

- Funding and investment support: Access to various funding schemes, venture capital funds, and tax exemptions on capital gains.

- Regulatory benefits: Simplified compliance and regulatory procedures, self-certification, and faster approvals.

- Networking and collaboration opportunities: Access to mentorship, incubation support, and networking events.

- Intellectual property rights (IPR) support: Guidance and assistance in filing patents and protecting intellectual property.

India has emerged as the third-largest startup ecosystem globally after the United States and China, with over 1,12,718 DPIIT-recognized startups nationwide.

Also Read: Types Of eCommerce Websites And Models

➢ Tax Registrations in India

Tax Registrations in India are essential for businesses to comply with taxation laws. From GST to PAN to TAN registrations, businesses can meet their tax obligations and ensure compliance with regulatory requirements.

❖ Registration for GST

GST (Goods and Services Tax) registration is mandatory for businesses in India that supply goods and services. It is a unified indirect tax levied on the sale, manufacture, and consumption of goods and services across India.

❖ Who is Required to Register for GST?

GST Registration is required for all businesses and individuals with an annual revenue of more than Rs.20 lakhs in most regions and Rs.10 lakhs in Special Category Provinces. Furthermore, regardless of revenue, anyone providing products for intrastate sale must register for GST.

In addition to the foregoing criteria, the GST Act provides numerous other criteria defining the GST registration requirement. Understanding the conditions and acquiring GST registration within one month of beginning a business is critical for everyone.

- Any business whose annual turnover exceeds the government’s threshold limit (which varies depending on the type of business and area).

- Businesses engaged in interstate commerce or e-commerce.

- E-commerce platforms enable businesses to offer their products or services online.

- Casual taxable persons or non-resident taxable individuals.

- Enter service distributors.

- Those are paying taxes through the reverse charge system.

- Local businesses or companies that supply goods and services must pay GST tax.

❖ Benefits of GST RegistrationBenefits of GST Registration

- Legality and Compliance: It ensures your firm complies with Indian tax regulations.

- Input Tax Credit: Registered businesses can claim input tax credit for GST paid on purchases, lowering their total tax bill.

- Interstate Trade: Allows firms to conduct interstate trade without restrictions.

- Business Expansion: Provides a common taxation structure across the country, making it easier for businesses to expand.

- Legal Protection: Offers legal protection against noncompliance and tax avoidance.

❖ PAN and TAN Registration

- PAN (Permanent Account Number): The Income Tax Department issues a unique 10-digit alphanumeric identity. All firms must obtain a PAN to perform financial activities and file taxes.

- TAN (Tax Deduction and Collection Account Number): The TAN Number is necessary for firms that deduct or collect tax at the source. Businesses must deduct, deposit, and file TDS returns.

❖ Income Tax Return Filing

- Companies and enterprises must file annual income tax returns with the Income Tax Department. The due date varies with the type of organization and its turnover.

- Income tax returns must be completed correctly, indicating the company’s or business’s income, deductions, and tax liabilities.

Note: Proper GST registration and early and accurate filing of income tax returns ensure compliance with tax regulations and avoid fines. Businesses must follow tax rules and meet their tax responsibilities on time.

Industry-Specific Permits

Here are some of the industry-specific permits you will require to run a business in some cases:

1. Drug License

Businesses that manufacture, sell, or distribute pharmaceuticals and medicines must obtain a license from the Drug Control Department.

2. Import-Export License

Companies importing or exporting goods or services must receive an Import Export Code (IEC) from the Directorate General of Foreign Trade (DGTF). To get an IEC, the company must have both a permanent account number (PAN) and a bank account.

3. FSSAI License for Food Businesses

The Food Safety and Standard Authority of India (FSSAI) is the Indian government body in charge of sanitizing and standardizing all food products distributed throughout the country.

If you want to start a food business, whether it’s selling packaged food, running a restaurant, using a cloud kitchen, or any other model, you must first get a license from the FSSAI.

There are three sorts of FSSAI licenses, which are classified according to business turnover:

- FSSAI Basic Registration: turnover up to INR 1.2 million.

- FSSAI State License: turnover of INR 1.2 million to INR 200 million.

- FSSAI Central License: turnover exceeds INR 200 million.

4. Shop and Establishment License

Companies that open a retail store in India must get a license under the Shops and Establishments Act. The guidelines will range from state to state because the Act is issued by state governments. The Act oversees all local enterprises and requires no infractions of child labor, working hours, working conditions, or wage policies.

5. Fire department license

A fire department permit is required for businesses that handle hazardous products and are open to the public (such as restaurants, hotels, and gas stations).

6. Air and water pollution permit

If the company uses natural resources to manufacture products, the Environmental Department demands permission. To avoid problems, this permission must be obtained before any building work begins.

7. Pollution Control Board License

Businesses that impact the environment, such as manufacturing and waste management facilities, must get a Pollution Control Board license.

8. Other Registrations and Licenses

Many companies that supply or offer financial services, insurance, defense-related services, broadcasting services, and so on must obtain regulatory approval from organizations such as the Reserve Bank of India, IRDAI, and others.

Note that the licenses and permits required for a business may differ based on the type of the company and the state in which it operates.

Other Registration for Businesses in India:

➔ Trademark registration

Trademark registration in India safeguards your company’s identity and brand. Contact the Controller General of Patents, Designs, and Trademarks to register a trademark via the internet portal or a trademark attorney.

Ensure your trademark is distinctive, not generic, and does not infringe on any existing trademarks. Once authorized, your trademark will be valid for ten years and renewed indefinitely.

➔ International trade

You can apply for international trade after obtaining an Export-Import license, GST, and other necessary department permissions. Depending on the nature of your products, you may need to register with various Export Promotion Councils (EPCs) in your business to take advantage of perks and incentives.

➔ Business bank account

In India, startups and small enterprises do not legally need to create a current account, yet doing so has numerous advantages. Opening a business bank account is essential for separating personal and corporate finances, adhering to legal regulations, and obtaining personalized banking services.

You will normally be required to produce your business registration, identification, proof of address, and tax identification number. You can apply online or go to the bank in person. Once accepted, you’ll have a dedicated account to manage your company’s funds effectively.

How to Apply for a Business License in India?

Step 1: Before applying for licenses, register your firm with the proper authorities. This could entail registration as a sole proprietorship, partnership, limited liability partnership (LLP), private limited company, or public business.

Step 2: If not already obtained, apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

Step 3: Apply for State-Specific Licenses depending on your business activities and location, you may need to apply for state-specific licenses and permits.

Step 4: Collect all necessary documents, such as identification proof, address proof, business registration documents, NOCs (No Objection Certificates), affidavits, partnership deeds, etc., as per the requirements of each license.

Step 5: Submit the Application and Pay Fees. Submit the completed application forms and all required documentation to the authorized authorities. Pay the fees required to process the license application.

Step 6: Regularly track your application status and respond quickly to any questions or requests from the licensing authority. Once accepted, confirm that the issued permits comply with all requirements and restrictions.

Step 7: To ensure the continued legal operation of your business, renew your business licenses periodically according to the renewal terms specified by the authorities.

Eligibility to get a license in India:

To apply for a business license, you have to meet the following requirements:

- Applicants must be at least 18 years old.

- The applicant must not have a criminal record or be on legal probation for serious offences.

- The business must be legal according to Indian Laws and regulations.

It’s important to research thoroughly and consult with legal advisors or business consultants to understand the licensing requirements applicable to your business in India and navigate the application process effectively.

Also Read: Will eCommerce Dominate Physical Stores – What’s The Future?

Conclusion

Starting a business in India entails obtaining a variety of licenses and registrations. These include tax registrations, industry permissions, trademark registrations, and more. Entrepreneurs can assure legal compliance and business success by following the steps mentioned in the blog and satisfying the essential criteria.

It is critical to get expert advice and stay up to date on regulatory developments in order to protect and grow your business in the Indian market.

FAQs

It can take a few weeks to a few months, depending on your business type and location. You’ll need to apply, get approvals, and maybe have inspections.

No, they’re different. A business license lets you operate in an area, while permits give permission for specific activities like building or health-related work.

You could face fines, penalties, and even get shut down. It hurts your reputation, affects contracts, and makes getting money tough. Following the rules is key for staying legit and trustworthy.